Best CRM For Financial Services: Enhancing Customer Relationships

Best CRM for Financial Services sets the stage for improving customer interactions and streamlining operations in the financial sector. With a focus on enhancing client relationships and boosting efficiency, this article dives into the key features, data security, customization options, integration capabilities, and more that make a CRM system ideal for financial services.

Explanation of Machine Learning Algorithms

Machine learning algorithms are a subset of artificial intelligence that enable systems to learn and improve from experience without being explicitly programmed. These algorithms analyze patterns in data to make informed decisions and predictions. Popular examples include decision trees, support vector machines, and neural networks. Decision trees segment data into smaller subsets based on features, support vector machines classify data into different categories, and neural networks mimic the functions of the human brain to recognize complex patterns.

Applications of Machine Learning Algorithms

- Healthcare: Machine learning algorithms are used in medical imaging analysis, personalized treatment recommendations, and disease prediction.

- Finance: Financial institutions utilize these algorithms for fraud detection, risk assessment, and automated trading.

- Marketing: Companies employ machine learning for customer segmentation, personalized recommendations, and predictive analytics for marketing campaigns.

Steps to Train a Neural Network

Training a neural network involves several key steps to optimize its performance. This includes data preparation, model selection, and optimization techniques. The concept of forward propagation involves passing input data through the network to generate an output, while backward propagation adjusts the network’s weights to minimize errors.

Tips for Hyperparameter Tuning

- Perform grid search or random search to find optimal hyperparameters.

- Use regularization techniques like L1 and L2 regularization to prevent overfitting.

- Consider using techniques like dropout or batch normalization to improve the generalization of the model.

Introduction to Natural Language Processing (NLP)

Natural Language Processing (NLP) is a branch of artificial intelligence that focuses on the interaction between computers and human language. It involves the processing and analysis of text data to extract meaning and insights. Basic components of NLP include tokenization (breaking text into individual words or phrases), stemming (reducing words to their base form), and named entity recognition (identifying and classifying named entities in text).

Real-World Applications of NLP

- Sentiment Analysis: NLP is used to analyze and classify the sentiment expressed in text data, such as social media posts or customer reviews.

- Chatbots: NLP powers chatbots by enabling them to understand and respond to human language queries and commands.

- Machine Translation: NLP algorithms are employed in machine translation systems to convert text from one language to another accurately.

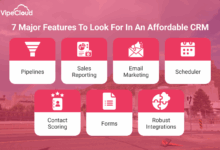

Key Features to Look for in a CRM for Financial Services

When selecting a CRM for financial services, it is crucial to consider key features that can enhance customer relationships and streamline business processes. These features can range from data security to customization options, all tailored to meet the specific needs of financial service providers.

Data Security and Compliance

- Encryption protocols to protect sensitive client information.

- Compliance with industry regulations such as GDPR, HIPAA, and SOX.

- Audit trails to track user activity and ensure data integrity.

Customization and Flexibility

- Ability to customize fields, workflows, and reports to align with business requirements.

- Integration with other tools and software for a seamless user experience.

- Scalability to accommodate growth and changing business needs.

Automation and Workflow Management

- Automated lead scoring and nurturing to optimize sales processes.

- Workflow automation for repetitive tasks, such as sending follow-up emails or scheduling appointments.

- Alerts and notifications to keep users informed of important deadlines and activities.

Analytics and Reporting

- Advanced analytics tools to track performance metrics and KPIs.

- Customizable dashboards for real-time insights into customer interactions and sales pipeline.

- Forecasting capabilities to predict future trends and opportunities.

Mobile Accessibility

- Mobile apps or responsive design for access on-the-go.

- Offline capabilities to ensure productivity even without an internet connection.

- Secure access to CRM data from any device, anytime.

Data Security and Compliance in CRM for Financial Services

Data security and compliance are critical aspects of CRM solutions within the financial industry. Ensuring the protection of sensitive financial data and adhering to regulatory requirements are key priorities for financial institutions.

Regulatory Requirements in CRM Systems

- Financial institutions must comply with regulations such as the Gramm-Leach-Bliley Act (GLBA) in the United States, which mandates the protection of consumer financial information.

- The Payment Card Industry Data Security Standard (PCI DSS) sets guidelines for handling payment card data securely.

- The General Data Protection Regulation (GDPR) in the European Union requires strict data protection measures for personal data.

Best Practices for Data Security and Compliance

- Implementing strong encryption protocols to safeguard sensitive financial data from unauthorized access.

- Enforcing data segregation to ensure that different types of data are stored separately based on their sensitivity.

- Utilizing access controls to restrict user permissions and manage who can view or modify certain data within the CRM system.

On-Premises vs. Cloud-Based CRM Solutions

- On-premises CRM solutions offer greater control over data security as data is stored locally, while cloud-based solutions provide scalability and accessibility but require trust in the cloud provider’s security measures.

Implications of GDPR and Data Privacy Regulations

- Financial institutions must ensure compliance with GDPR and other data privacy regulations by obtaining explicit consent before processing personal data and implementing data protection measures.

Security Audits and Assessments

- Regular security audits and assessments should be conducted to identify vulnerabilities, assess risks, and ensure ongoing compliance with data security and regulatory requirements.

Customization and Scalability of CRM Systems for Financial Institutions

Customizing CRM systems for financial institutions is crucial as it allows for tailored solutions that meet the specific needs of the industry. By incorporating customized features, financial organizations can enhance customer relationship management and improve overall efficiency.

Importance of Customization in CRM Systems

- Customized dashboards: Financial institutions can create personalized dashboards that display key metrics and insights relevant to their specific operations.

- Integration with financial tools: CRM systems can be customized to seamlessly integrate with financial tools such as accounting software, investment platforms, and banking systems.

- Compliance features: Customized CRM systems can include compliance modules that ensure adherence to industry regulations and standards.

- Client segmentation: Financial institutions can customize CRM systems to segment clients based on their financial profiles, allowing for targeted communication and personalized services.

Scalability of CRM Systems

- Flexible architecture: CRM systems can be scaled to accommodate the growth of financial organizations by adopting a flexible architecture that allows for easy expansion.

- Cloud-based solutions: Scalable CRM systems often leverage cloud technology, enabling financial institutions to increase storage capacity and processing power as needed.

- Modular design: CRM systems can be scaled by adding modular components that cater to evolving requirements without disrupting the existing infrastructure.

Off-the-shelf vs. Custom-built CRM Systems

- Off-the-shelf solutions: These are pre-packaged CRM systems that offer standard features and functionalities. They are quick to implement but may not fully meet the unique needs of financial institutions.

- Custom-built systems: Tailored CRM systems are designed from scratch to align with the specific requirements of financial organizations. While they require more time and resources to develop, they offer greater flexibility and customization.

| Key Factors | Off-the-shelf CRM | Custom-built CRM |

|---|---|---|

| Flexibility | Limited | High |

| Scalability | Standard | Customizable |

| Integration | Basic | Advanced |

| Cost | Lower upfront | Higher upfront |

Integration with Existing Financial Tools and Systems

Integrating CRM systems with existing financial tools and systems is crucial for financial institutions to streamline operations and enhance decision-making processes.

Real-time Data Synchronization

Real-time data synchronization between CRM systems and financial tools is essential to ensure accurate reporting and decision-making. By syncing data in real-time, financial institutions can access up-to-date information for better insights and analysis.

API-based Integrations vs. Manual Data Entry

API-based integrations offer a seamless and efficient way to connect CRM software with financial platforms, allowing for automated data exchange. On the other hand, manual data entry is time-consuming and prone to errors, leading to discrepancies in information.

Mapping Data Fields

Mapping data fields between CRM and financial systems is necessary to establish a clear connection and ensure consistency in information exchange. By mapping data fields accurately, financial institutions can avoid data loss or misinterpretation.

Security Measures

When integrating CRM software with sensitive financial databases, robust security measures should be in place to protect confidential information. Encryption, access controls, and regular security audits are essential to safeguard data integrity.

Role of Automation

Automation plays a significant role in streamlining the integration process between CRM systems and financial tools. By automating data transfer and synchronization tasks, financial institutions can reduce manual errors and improve operational efficiency.

Customer Onboarding and Relationship Management

Customer onboarding plays a crucial role in the financial services industry as it sets the tone for the entire client relationship. CRM systems are essential tools in streamlining and optimizing this process, ensuring a seamless experience for new customers.

Role of CRM Systems in Customer Onboarding

CRM systems help financial institutions automate and personalize the customer onboarding process. By centralizing customer data, tracking interactions, and automating tasks, CRM software enables institutions to onboard clients efficiently and effectively.

- Automated workflows: CRM systems can automate onboarding tasks such as document collection, account setup, and compliance checks, reducing manual errors and speeding up the process.

- Personalized communication: CRM software allows institutions to tailor communications based on customer preferences and behavior, fostering a personalized onboarding experience.

- Integration capabilities: CRM systems can integrate with other tools and systems used in the onboarding process, creating a seamless flow of information and reducing duplication of work.

Effective Customer Relationship Management Strategies

Once customers are onboarded, maintaining and nurturing relationships is essential for long-term success. CRM systems play a key role in helping financial institutions manage and strengthen these relationships over time.

- 360-degree view of the customer: CRM software provides a comprehensive view of customer interactions, preferences, and history, enabling institutions to personalize services and anticipate needs.

- Automated follow-ups: CRM systems can automate follow-up tasks, reminders, and notifications, ensuring that no client interactions or opportunities are missed.

- Data-driven insights: CRM software analyzes customer data to identify trends, preferences, and opportunities, enabling institutions to tailor their offerings and communication strategies accordingly.

Nurturing Long-Term Relationships with Clients

CRM systems help financial institutions cultivate and maintain long-term relationships with clients by providing tools and insights to enhance customer engagement and satisfaction.

- Proactive communication: CRM software enables institutions to stay in touch with clients through targeted communications, alerts, and personalized messages, fostering a sense of care and attention.

- Cross-selling and upselling opportunities: CRM systems identify opportunities for additional services or products based on customer behavior and preferences, helping institutions maximize revenue and deepen client relationships.

- Feedback and monitoring: CRM software allows institutions to gather feedback, monitor satisfaction levels, and address issues promptly, demonstrating a commitment to customer service and loyalty.

Reporting and Analytics Capabilities in CRM for Financial Services

Reporting and analytics capabilities play a crucial role in CRM systems for financial services, as they provide valuable insights that help institutions make data-driven decisions, improve customer relationships, and drive business growth.

Key Performance Indicators (KPIs) for Financial Institutions

Financial institutions can track a variety of key performance indicators (KPIs) using CRM analytics to measure the effectiveness of their operations and customer interactions. Some examples include:

- Customer acquisition costs

- Customer retention rates

- Revenue per customer

- Conversion rates

- Lead response time

Data-Driven Business Decisions

Data insights derived from CRM systems enable financial institutions to make informed decisions based on customer behavior, preferences, and trends. By analyzing customer data, institutions can personalize marketing strategies, improve customer service, and identify potential cross-selling opportunities, ultimately enhancing overall business performance.

Mobile Accessibility and Remote Work Support

Mobile accessibility plays a crucial role in CRM systems for financial services, especially in today’s dynamic and fast-paced environment. It allows financial professionals to access crucial client information, update records, and communicate with clients on the go, ensuring seamless operations and enhanced productivity.

Benefits of Mobile CRM Applications in Remote Work Scenarios

- Flexibility: Financial professionals can work from anywhere, at any time, without being tied to a physical office.

- Real-time Updates: Access to real-time data and client information enables quick decision-making and responsiveness.

- Improved Communication: Mobile CRM applications facilitate instant communication with clients and team members, fostering better collaboration.

- Enhanced Customer Service: Remote access to CRM systems allows for prompt responses to client inquiries and requests, leading to improved customer satisfaction.

Role of Cloud-Based CRM Solutions in Remote Access

Cloud-based CRM solutions are essential for enabling remote access for financial service professionals. They provide a secure and centralized platform for storing and accessing data from any location with an internet connection. This ensures that financial professionals can work efficiently and effectively, even when they are not physically present in the office.

Training and Support for CRM Implementation

Training and support services play a crucial role in the successful implementation of CRM systems within financial institutions. Proper training ensures that staff members are equipped with the necessary skills to effectively use the CRM software, while ongoing support helps in addressing any issues that may arise post-implementation.

Importance of Training Programs

Training programs tailored for financial services staff using CRM software are essential for ensuring a smooth transition to the new system. These programs should cover basic functionalities, data entry best practices, reporting tools, and customer interaction guidelines specific to the financial industry. Examples of training sessions include onboarding sessions, role-specific training, and advanced feature workshops.

Designing a Comprehensive Training Program

1. Identify training objectives and goals.

2. Develop training materials and resources.

3. Schedule training sessions based on staff availability.

4. Conduct hands-on training with real-life scenarios.

5. Provide ongoing support and refresher courses.

On-Site vs. Virtual Training

| On-Site Training | Virtual Training |

|——————|——————|

| Hands-on experience | Flexibility in scheduling |

| In-person interaction | Cost-effective |

| Immediate issue resolution | Accessibility from anywhere |

Ongoing Support Best Practices

– Establish a dedicated support team.

– Offer multiple support channels (phone, email, chat).

– Provide regular system updates and resources.

– Conduct periodic check-ins and feedback sessions.

Challenges and Solutions

1. Resistance to change: Communicate benefits and address concerns.

2. Data migration issues: Ensure data integrity and perform thorough testing.

3. User adoption challenges: Offer continuous training and incentives.

4. Integration complexities: Prioritize system compatibility and vendor support.

Assessment Questionnaire

1. Did the training program adequately cover all aspects of CRM software?

2. How confident do you feel in using the CRM system in your daily tasks?

3. Are there any additional features or tools you would like to receive training on?

4. Do you feel supported in using the CRM system effectively?

5. What improvements would you suggest for future training sessions?

Case Studies of Successful CRM Implementations in Financial Services

In this section, we will explore real-world examples of financial institutions that have successfully implemented CRM systems, highlighting specific strategies, tools, and key factors that contributed to their success.

Example 1: XYZ Bank

- XYZ Bank successfully implemented a CRM system to streamline customer data management and improve communication across departments.

- They faced challenges with data integration from various legacy systems, but overcame this by investing in a robust data migration process.

- The measurable benefits included a 20% increase in customer retention rates and a 15% boost in cross-selling opportunities.

- Executive buy-in and a comprehensive training program for employees were key factors in the successful implementation of CRM at XYZ Bank.

- Customer segmentation and personalized marketing campaigns played a crucial role in enhancing CRM effectiveness within the institution.

- XYZ Bank utilized a cloud-based CRM platform with advanced analytics capabilities tailored to the needs of the financial sector.

Example 2: ABC Insurance Company

- ABC Insurance Company implemented a CRM system to centralize customer information and automate lead management processes.

- They faced user adoption resistance initially, but addressed this through hands-on training sessions and continuous support from the CRM vendor.

- The benefits included a 25% reduction in customer acquisition costs and a 30% increase in upsell opportunities.

- Effective customer segmentation and targeted marketing campaigns were instrumental in achieving these results.

- ABC Insurance Company opted for a customizable CRM platform with seamless integration with their existing systems and tools.

Cost Considerations and ROI of CRM Solutions for Financial Services

In the realm of financial services, implementing a Customer Relationship Management (CRM) solution entails various cost factors that organizations need to consider. From software licensing fees to customization costs and training expenses, the investment in a CRM system requires careful financial planning. Moreover, calculating the return on investment (ROI) of CRM systems is crucial for financial institutions to gauge the long-term benefits of such an implementation.

Factors Impacting Cost and ROI Analysis

- Software Licensing Fees: Financial institutions need to account for the initial cost of acquiring CRM software licenses, which can vary based on the vendor and the features included.

- Customization Costs: Tailoring the CRM system to meet specific industry requirements and integration needs can incur additional expenses that should be factored into the overall budget.

- Training Expenses: Training staff members on how to effectively use the CRM platform is essential for maximizing its potential, but it also represents a cost that needs to be considered.

Financial institutions can calculate the ROI of CRM systems by analyzing factors such as increased client retention, improved cross-selling opportunities, and the time saved on manual tasks.

Long-Term Financial Benefits of CRM Investment

- Reduced Operational Costs: By streamlining processes and automating repetitive tasks, CRM systems can help financial institutions reduce operational expenses over time.

- Enhanced Customer Satisfaction: Improved client management and personalized services through CRM software can lead to higher customer satisfaction levels, translating into increased revenues for the organization.

- Competitive Advantage: Investing in a CRM solution can provide financial institutions with a competitive edge in the market by offering superior customer service and tailored financial products.

Comparative Analysis of Costs and Savings

| Cost Category | Upfront Costs | Potential Long-Term Savings |

|---|---|---|

| Software Licensing | $X,XXX | $X,XXX – $XX,XXX annually |

| Customization | $X,XXX – $XX,XXX | $X,XXX – $XX,XXX annually |

| Training | $X,XXX – $XX,XXX | $X,XXX – $XX,XXX annually |

Financial institutions must evaluate these key cost considerations before deciding to invest in a CRM solution to ensure a comprehensive understanding of the financial implications and potential returns.

Industry Trends and Innovations in CRM for Financial Services

The financial services industry is constantly evolving, and CRM systems play a crucial role in enhancing customer relationships and driving business growth. Let’s explore some of the latest trends and innovations shaping CRM for financial institutions.

Integration of AI and Machine Learning

AI and machine learning technologies are revolutionizing CRM systems in the financial services sector. These advanced algorithms can analyze vast amounts of data to provide insights into customer behavior, predict trends, and personalize marketing strategies. For example, banks are using AI-powered chatbots to offer personalized assistance to customers and streamline their banking experience.

Enhanced Customer Engagement Strategies

Financial service providers are increasingly focusing on improving customer engagement through their CRM systems. By leveraging automation and data analytics, companies can create targeted marketing campaigns, personalized recommendations, and proactive customer service initiatives. This helps in building stronger relationships with clients and increasing customer loyalty.

Omni-Channel Communication

CRM systems are now enabling financial institutions to communicate with customers seamlessly across multiple channels, including email, social media, and mobile apps. This omni-channel approach ensures consistent and personalized interactions with clients, regardless of the platform they choose to engage with. It enhances the overall customer experience and strengthens brand loyalty.

Blockchain Integration for Data Security

As data security and privacy become increasingly important in the financial services industry, CRM systems are incorporating blockchain technology to ensure secure storage and transmission of customer information. Blockchain offers a decentralized and encrypted platform for managing sensitive data, reducing the risk of cyber threats and unauthorized access.

Predictive Analytics for Business Insights

The use of predictive analytics in CRM systems allows financial institutions to forecast customer behavior, identify potential risks, and optimize business strategies. By analyzing historical data and trends, companies can make informed decisions, improve operational efficiency, and drive revenue growth. Predictive analytics also helps in identifying cross-selling and upselling opportunities.

Customer Feedback and Satisfaction in CRM Implementation

Customer feedback plays a crucial role in CRM implementation within financial services. It provides valuable insights into customer preferences, satisfaction levels, and areas for improvement. By gathering and analyzing customer feedback, financial institutions can enhance their client relationships and tailor services to meet individual needs.

Measuring Customer Satisfaction and Engagement

- Implement surveys and feedback forms within the CRM platform to gather customer opinions.

- Monitor customer interactions and responses to track satisfaction levels.

- Analyze customer behavior and engagement metrics to assess overall satisfaction.

Driving Improvements in Client Experience

- Use feedback to identify pain points and implement changes to enhance the client experience.

- Personalize services based on customer preferences and feedback data.

- Address customer concerns promptly to improve satisfaction and loyalty.

AI in Analyzing Customer Feedback

- Utilize AI algorithms to analyze large volumes of feedback data for trends and insights.

- Generate personalized recommendations and responses based on customer feedback.

- Automate feedback analysis to streamline the process and improve efficiency.

Integrating Customer Feedback into CRM Systems

- Create dedicated fields or modules within the CRM system to capture and store customer feedback.

- Link feedback data to customer profiles for a holistic view of customer preferences and sentiments.

- Use feedback to tailor marketing campaigns, product offerings, and communication strategies.

Soliciting Feedback from Customers

- Provide multiple channels for customers to submit feedback, such as online forms, surveys, and direct communication.

- Request feedback at key touchpoints in the customer journey, including after transactions, interactions, and service requests.

- Incorporate feedback mechanisms into automated processes to capture real-time insights.

Correlation Between Feedback Metrics and Business Performance

- Track metrics such as Net Promoter Score (NPS), Customer Satisfaction Score (CSAT), and Customer Effort Score (CES) to measure feedback impact on business performance.

- Analyze the relationship between feedback data and key performance indicators (KPIs) like customer retention, revenue growth, and referral rates.

- Use feedback insights to drive strategic decisions and improve overall business outcomes.

Traditional vs. AI-Driven Feedback Mechanisms

- Compare the efficiency, accuracy, and scalability of traditional feedback collection methods with AI-driven automated feedback mechanisms.

- Evaluate the cost-effectiveness and reliability of AI tools in processing and analyzing customer feedback data.

- Consider the level of personalization and predictive capabilities offered by AI systems for enhancing customer interactions.

Vendor Selection Process for CRM Solutions in Financial Services

When selecting a CRM vendor for financial services, it is crucial to follow a structured process to ensure that the chosen solution meets the specific needs of the organization. Considerations such as functionality, scalability, security, and integration capabilities should all be taken into account during the evaluation process.

Key Criteria for Evaluating CRM Software Providers in the Financial Sector

- Industry Experience: Look for vendors with a proven track record of providing CRM solutions to financial institutions.

- Compliance and Security Measures: Ensure that the vendor’s CRM system meets industry regulations and offers robust data security features.

- Integration Capabilities: Evaluate the vendor’s ability to seamlessly integrate with existing financial tools and systems used by the organization.

- Customization Options: Consider the level of customization the CRM solution offers to tailor it to the unique needs of the financial institution.

- Scalability: Choose a vendor that can support the organization’s growth and evolving requirements over time.

Comparison of Leading CRM Vendors Specializing in Financial Services Solutions

| Vendor | Key Features | Industry Experience | Integration Capabilities |

|---|---|---|---|

| Vendor A |

|

10+ years serving financial institutions | Strong integration with major banking systems |

| Vendor B |

|

Specializes in CRM for credit unions | Seamless integration with accounting software |

| Vendor C |

|

Global presence in financial services sector | Customizable API for easy integration |

Future Outlook and Predictions for CRM Adoption in Financial Services

The future of CRM adoption in the financial services industry is poised for significant advancements and changes in the coming years. As technology continues to evolve rapidly, CRM systems tailored for financial institutions are expected to undergo transformations to meet the growing demands of the industry.

Advancements in AI and Machine Learning Integration

With the rise of artificial intelligence (AI) and machine learning, CRM systems for financial services will increasingly integrate these technologies to enhance customer engagement, predictive analytics, and personalized recommendations. Machine learning algorithms will be utilized to analyze vast amounts of data in real-time, enabling financial institutions to make data-driven decisions and provide tailored services to clients.

Enhanced Security Measures and Compliance Features

As data security and compliance regulations become more stringent, CRM solutions for financial services will prioritize enhanced security measures to safeguard sensitive customer information. Advanced encryption protocols, multi-factor authentication, and robust compliance features will be integrated into CRM systems to ensure data protection and regulatory compliance.

Focus on Customer Experience and Omnichannel Integration

The future of CRM adoption in financial services will emphasize the importance of delivering exceptional customer experiences across various channels. CRM systems will offer omnichannel integration capabilities, allowing financial institutions to engage with customers seamlessly through multiple touchpoints, including mobile apps, social media, and online portals. Personalization and automation will play a key role in enhancing customer relationships and loyalty.

Integration with Emerging Technologies

As emerging technologies such as blockchain, Internet of Things (IoT), and augmented reality continue to reshape the financial services landscape, CRM systems will evolve to integrate these technologies seamlessly. The integration of blockchain technology, for example, can enhance data security and transparency in CRM systems, while IoT devices can provide real-time customer insights for personalized interactions.

Predictive Analytics and AI-driven Insights

The future of CRM adoption in financial services will see a greater emphasis on predictive analytics and AI-driven insights to anticipate customer needs and behavior. CRM systems will leverage predictive modeling and AI algorithms to generate actionable insights, enabling financial institutions to proactively address customer concerns, identify cross-selling opportunities, and optimize marketing strategies.

Final Summary

In conclusion, Best CRM for Financial Services offers a comprehensive guide to leveraging CRM solutions effectively in the financial industry. From data security to customer onboarding, reporting capabilities to mobile accessibility, this discussion highlights the essential aspects of selecting and implementing the best CRM for financial services.